How to Earn more interest rates on your Savings Bank Account

Fixed Deposit Sweep-in or Auto-sweep

Consider you earn your salary or you have a source of income each month and you have drawn enough for the month’s expenses and investments and is left out with some surplus(extra) money… or

You have faced financial emergencies or heard from who have faced it and have realized that nothing but cash in the bank account comes handy when an emergency strikes. So you are maintaining some amount in your savings account for emergency purposes, which is unused until that need arises…

Many of you might be making regular investments in different asset classes, few may even keep surplus money in Fixed Deposit (FD) as it is deemed safe (know that FDs don’t offer the same flexibility and liquidity as bank savings account would offer, also premature withdrawals of FD attract penalties).

Now that the pandemic has once again put the focus back on having emergency funds on top of any other financial investments, many agree that having contingency reserves in the form of emergency fund in our savings account is the safest bet.

Recent experience shows financial markets cannot be the right choice even as liquid funds, which most advisors suggested for emergency corpus(funds), gave negative returns. Also advancements have brought down the interest rates of Savings account to as low as 2.5% to 3% annually. While these contingency funds are not to be invested but kept for unforeseen circumstances, how do you make this money earn a comparatively highly interest, double the interest?

Do you know that you can give standing instructions to your bank to put aside your surplus amount in savings account using Auto-sweep or Sweep-in facility which can give you FD-like interest rate, yet SB account-like liquidity?

What is a Fixed Deposit Sweep-in or Auto-sweep facility?

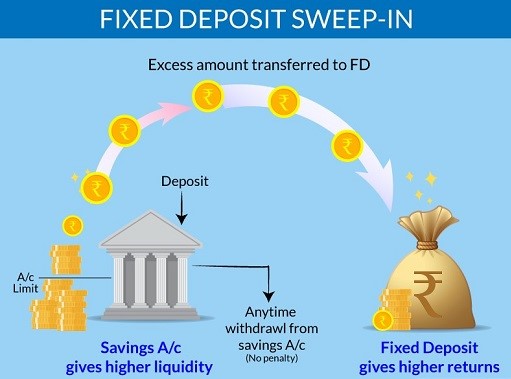

The Fixed Deposit “Sweep-in” or “Auto-Sweep” is a facility which allows your bank to transfer any excess amount set by you from your savings account (or current account) to a sweep-in deposit.

To avail this facility, you should have a savings (or a current) account linked to your fixed deposit (FD) account. You (the depositor) must then set a specific limit so that when the balance in your savings or current account exceeds this limit, the balance is transferred to your linked fixed deposit account.

The tenure of the deposit varies from one year to five years, and the interest rates also vary accordingly. But by and large, the amount transferred to FD is likely to earn you a higher returns (as per the prevailing FD interest rates) than your normal savings account.

Here is an illustration for better understanding: Recently, Ms.Ananya linked her savings account with an auto sweep fixed deposit account for 1-year tenure. She has opted for the sweep-in facility and has chosen a threshold limit of ₹30,000 beyond which any amount will automatically be transferred through a sweep process to book a FD.

Her current balance is ₹20,000. She receives ₹30,000 as a cheque from her client that she encashes into her savings account. Now, the bank balance reaches ₹50,000 which is ₹20,000 above the limit she had set. Therefore, the bank automatically transfers the excess of ₹20,000 to her linked FD account, earning her more interest than if it was left in savings account.

Eligibility for Sweep-in account

The sweep-in facility is not offered to all bank customers. The facility is only available for resident Indians, HUFs, private and public firms among others. The features, terms and conditions, criteria may vary from bank to bank, contact your bank branch to know the same.

In few banks like Canara Bank, you need not maintain any balance in your deposit account. Typically, in order to be eligible for it, you have to open an FD of at least ₹25,000 with your bank. Alternatively you could open a premium account wherein the minimum balance on either a monthly or quarterly basis is in the range of ₹25,000 – ₹1,00,000.

How does Sweep-in facility benefit you?

- Higher Interest Rate: If you are risk-averse investor, Sweep-in facility is for you, as it earns a higher interest rate from the FD compared to Savings account. Some banks may even offer additional interest rate to senior citizens.

- Liquidity: It offers the best form of liquidity. If you have an EMI coming up or a cheque to be disbursed and you are running low on funds in your Savings Accounts which has been selected to be linked with an FD for the sweep-in facility, the bank will simply transfer or sweep in funds into your Savings Account, thus the cheques or any other debit transaction from your account is not hindered due to lack of sufficient funds in your Savings/Current Account. You don’t lose interest on the fixed deposit, you lose interest only on the amount drawn or swept. For example, you have a sweep-in facility on your Savings Account which is linked to an FD for ₹10,000. You issued a cheque for ₹7,000. But the balance in the Savings Account is only ₹2,000. Now the bank will deduct the balance ₹5,000 from the FD linked to your Savings Account and draw down the amount to transfer it to your Savings Account. So, the cheque goes through.

- Emergency corpus: Major advantage the sweep-in facility offers is that it forms a separate corpus that you can dip into during emergencies, without touching your regular investments, without affecting your savings or having to liquidate FDs or even worrying about the interest since it will still continue to earn interest on the full fixed deposit amount.

- Allows multiple fixed deposits to be linked with Savings Account: you can link more than one fixed deposit to your Savings Account for sweep-in, just to make sure you never run out of cash liquidity. In such case, many banks follows the LIFO (Last In First Out) rule (Effective 2014), which is, on the sweep-in being triggered, the last deposited funds will be first transferred to your Savings Account, which makes your earlier deposits to continue earning interest under longer tenure.

- No Penalties: It has no fees or penalties on withdrawal. Even if you dip into the deposit, the balance amount will continue to earn interest at the same rate.

- Flexibility: Banks offer flexibility by allowing you to select the period of this deposit, the maturity and payment.

- Overdraft facility: Avail Overdraft facility against Fixed Deposit: Any individual who runs a small business and has a current account need not take an overdraft on the fixed deposit held by them with a sweep account. With this facility being available, you can now draw the exact amount you need, instead of an overdraft. Also there will be no additional fees or charges that need to be paid like in the case of overdraft facilities that are levied by banks.

- Sweep-out or reverse sweep: If you have exhausted the amount in a savings account, and still want more, the bank will automatically release required funds from sweep-in FD, but the rest of the amount will keep earning a higher interest rate, unlike regular FDs, which when broken, get credited to the SB account entirely. Any deficit in your Savings or Current Account is thus taken care of – the exact value comes from your Fixed Deposit. Here, the deposits are broken down in units of ₹1/- to ₹1,000, depending on the bank, and interest lost will be on the amount that’s swept and not the full deposit amount.

- Tax consideration: As per section 80TTA of Income Tax Act, there is a deduction on savings account interest up to Rs 10,000 per annum. Interest earned beyond Rs 10,000 gets added to an individual’s annual income. However, since sweep-in FDs, just like regular FDs, are term deposits, section 80TTA is not applicable to it. Interest earned on sweep-in FDs gets added to your income under the head ‘Income from other sources’ and taxed as per your slab rate. “At the highest slab, you may end up paying a tax of 31.2 per cent (plus surcharge if applicable) on the interest earned. There is no tax deduction on the interest earned except in the case of senior citizens (60 years and above) who are entitled to a deduction of Rs 50,000. On the other hand, an individual taxpayer less than 60 years of age can claim a deduction up to Rs 10,000 on interest earned from a savings account*” (*from Cleartax).

Note:

- Some banks have a maximum/ minimum limit for the FDs which can have sweep-in facility. For example, for HDFC Bank, FDs of amounts greater than or equal to ₹5 crore to less than ₹25 crores are not allowed for sweep-ins/sweep-outs.

- The term of deposit, interest rates offered vary from bank to bank. Also there might be a self-imposed limit on the balance to be maintained in the savings and current accounts. Most banks ask for a minimum average balance (MAB) ranging from ₹1,000 to ₹10,000 to be maintained in the savings bank account or current account.

- There might also be a minimum holding time for the FDs and anything less than that the interest may be forfeited. Look at the minimum tenure before the sweep-in facility kicks in. If you don’t keep the money for at least 30 days, most banks will offer a much lower interest on the FD. This means that it is only beneficial for you to go for an FD if your tenure is longer than 30 days. Otherwise you are better off with a savings account.

- Some banks like HDFC Bank do not allow the sweep-in facility for investments in securities or IPOs.

- For large ticket FDs, you may not be able to do it online but contact the bank branch.

- As a part of one’s financial plan, one should create an emergency fund that can meet 3-6 months of household expenses by keeping funds either in liquid mutual funds or sweep-in deposits. Sweep-in FDs or even regular fixed deposits should not be used for long-term goals. Not only is the interest rate taxable as per one’s tax slab, real returns are low post-inflation.

- You can opt for this facility if you usually maintain substantial idle balance in your savings account. If you have better financial investments to make, reconsider as this best applies to your idle funds.

How can you apply for sweep-in facility?

- Link your savings account (or your current account) with the fixed deposit account or open a sweep-in FD account.

- Set a threshold limit beyond which any excess funds in the savings account will be transferred automatically to the linked FD account.

- Doing it over the bank’s internet banking option is the easiest mode to opt (Login to your bank’s Net-banking, Choose Fixed Deposit Sweep-in under Fixed Deposit Tab, Pick your savings or current account and your FD account numbers and connect them). The same can be done by visiting the branch too.

- Pick the tenure of auto sweep FD and opt the method of withdrawal (LIFO or FIFO) provided by your bank.

Different banks have different names for the facility. For instance, State Bank of India’s savings plus account basically serves the same purpose. Any excess amount in the savings account is automatically transferred to a sweep-in deposit in multiples of ₹1,000. HDFC Bank offers it as a sweep-in fixed deposit while ICICI Bank calls it a flexi deposit, YES Bank names it as XLRATE savings account. India Post provides the facility of sweep-in and sweep out through ‘linkage process of IPPB and POSA’.

Difference between Sweep-In Facility and Flexi Deposit

Sweep-in and Flexi deposit are two facilities which provide the same benefit of higher interest rates combined with liquidity. While the sweep-in facility is an added feature to fixed deposit schemes, Flexi-deposit is, in itself, a separate scheme.

In Flexi-deposit, you must manually add money to your fixed deposit account. Also, you can anytime withdraw funds from the account, prematurely. Thus both benefits of higher returns as well as higher liquidity are combined in a single deposit scheme.

In Sweep-in facility, any excess amount get swept into a fixed deposit automatically. This amount can be anything from ₹1 and above the threshold limit set by you and it also doesn’t require you to open a new fixed deposit for this purpose. A Flexi Deposit on the other hand requires you to manually need to book a fixed deposit and then link the same with your savings or current account.

For a more convenient, easy and automatic method of keeping your surplus funds in a facility earning you a better interest rather than manually having to book it like in a Flexi deposit, you can use the Sweep In facility. With this facility there are no charges. penalties, or even fees for breaking the fixed deposit, you only lose interest rate on the amount taken out of the Sweep In account.

BONUS (?!):

Let me explain this in simple terms (without much of a jargon):

If you have a savings account in a bank and have any additional amount (other than for your immediate expenses) in it, saved for later plans or emergency purposes… then ask your manager to open a sweep-in account for you and connect your savings account to it. Now set a limit (for ex., 20,000 or 30,000 whatever is needed for your immediate expenses). Instruct the bank that any extra funds from your savings account above this limit must be moved to sweep-in account.

Thus while you have your emergency funds parked at safe place, it will continue to earn extra interest compared to your savings account.