PPF : Public Provident Fund

Your dream of becoming a crorepati can be realized through PPF

One Crore has been a significantly higher mark in the arena of personal finance. The millennials and Gen Z are fast learners when it comes to investment lessons and have the zeal to start saving and investing early. Here is my recent conversation with a younger friend who is a conservative and risk-averse investor yet wishes to retire with at least one crore in her account. This friend could be you and you can read it as if your questions are being answered.

Friend: Hi, Good evening! How was your day?

Me: Hey, good. How is yours? And what’s new?

Friend: Day was fine. Recently been worried about the future, this Corona virus crisis, increasing cost of living and inflation rate rising, I nowadays feel that my wish to have at least a crore or more in my account by the time I retire, will remain a dream.

Me: That’s interesting! When one starts investing, wealth creation is the ultimate goal that an earning individual looks at.

Friend: yea… However, in recent months due to the pandemic, the way unit-linked plans have underperformed and various other investment options tanked before rising a little, I am worried if there is any way I could achieve my one crore goal by the time I retire.

Me: How does it sound to retire rich with a retirement fund of one crore deposit in your account?

Friend: Attractive. Lucrative in fact! That’s my need. Any advice?

Me: Of course it is attractive. Well, let me suggest you a way to reach that one crore milestone.

Friend: Before that, do I have to deposit a huge chunk of the amount at the bank for that? Look I’m a conservative investor who prefers fixed income investment remaining in my safe budget.

Me: Nah, not a one-time huge deposit…But yea! A regular deposit of a certain amount either monthly or yearly must be done.

Friend: Okay, monthly or yearly investments must be fine. What is it?

Me: PPF. Public Provident Fund was introduced in India in 1968. Public Provident Fund (PPF) scheme is a long term investment option that offers an attractive rate of interest and returns on the amount invested.

Friend: But is it safe?

Me: Since PPF is backed by the Indian government, it offers guaranteed, risk-free returns as well as complete capital protection. PPF is one of the most popular and safest debt instrument as it has the sovereign backing of the government. Many savvy investors use PPF to meet the debt part of their investment portfolio. The element of risk involved in holding a PPF account is very minimal.

Friend: I am listening… Say me everything I need to know about PPF.

Me:

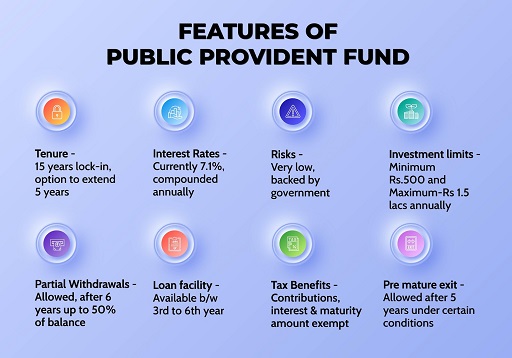

Essential features of PPF

- Eligibility: Any Indian citizen can invest in PPF. NRIs and HUFs are not eligible to open a PPF account.

- One citizen can have only one PPF account unless the second account is in the name of a minor.

- Tenure: The PPF has a minimum tenure of 15 years, which can be extended in blocks of 5 years if you wish. There is no upper limit on the number of times you can extend the tenure of the account as long as you extend it in the blocks of five years. However, you can only extend the tenure upon the maturity of each block and every time the account holder will have to submit Form-H to avail the extension of 5 years. So, if a PPF account holder wants to invest for 25 years, submit Form-H twice after 15 and 20 years of PPF account opening.

- Investment Limits: PPF allows a minimum investment of ₹500 and a maximum of ₹1.5 lakh for each financial year. Investments can be made in lump sum or in a maximum of 12 installments.

- Opening Balance: The account can be opened with just ₹100. Annual investments above ₹1.5 lakh will not earn interest and will not be eligible for tax saving.

- Deposit Frequency: Deposits into a PPF account has to be made at least once every year, for 15 years.

- Mode of deposit: The deposit into a PPF account can be made either by way of cash, cheque, Demand Draft or through an online fund transfer.

- Nomination: A PPF account holder can designate a nominee for his account either at the time of opening the account or subsequently.

- Joint accounts: A PPF account can be held only in the name of one individual. Opening an account in joint names is not allowed.

Friend: Oh Wait! You know what, any interest earned must be taxable? So I don’t think your theoretical calculations work practically.

Me: Relax! The most striking benefit is that PPF gives you one of the highest returns among the safest fixed income products. On top of that, it offers you the best tax saving options.

Analysts say PPF is the safest investment option to accumulate a large corpus in the long term. PPF falls in the ‘Exempt Exempt Exempt (EEE)’ investment category where the “amount you invest” every year (subject to the maximum limit of ₹ 1.5 lakh), “annual interest” earned on this account and the “maturity amount” are exempt from income tax. Triple benefit :). This, in other words, means that all deposits made in the PPF are deductible under Section 80C of the Income Tax Act.

The EEE benefit is available for only those earning individuals who file their Income Tax Return (ITR) by opting for the old income tax slab.

Friend: This sounds too good, so…

How to open a PPF account?

A PPF account can be opened with either a Post Office or with any nationalized bank like the State Bank of India or Canara Bank, etc. These days, even certain private banks like ICICI, HDFC and Axis Bank among others are authorized to provide this facility. You need to submit the duly filled application form along with the required documents i.e. the KYC documents like identity proof, address proof, and signature proof. Post submitting these documents you can deposit a prescribed amount towards the opening of the account.

Friend: So what will be the Returns on Investment or ROI?

Me: To get the best returns, you need to be patient and regularly invest for 15 to 25 years at the current interest rate of 7.1 per cent, utilizing the maximum limits of PPF investments allowed in one financial year. Periodic investments in PPF for the long term can do the trick with the power of compounding. The longer the money stays invested, the quicker it grows, experts say.

Friend: Can you explain to me with numbers, please.

Me: As per calculations, Assuming the present 7.1% average returns for the entire maturity period of 15 years, if one invests ₹1.5 lakh in a financial year (₹12,500 per month) in one’s PPF account, then according to PPF calculator, the maturity amount after 15 years will be ₹40,68,210.

Also, during the investment period, one will get an income tax exemption on investment up to ₹1.5 lakh every financial year. The maturity amount and the interest earned during the period will be 100 per cent income tax exempted.

The interest rate on PPF is decided by the government every quarter and usually, it remains higher compared to other fixed investment instruments.

Friend: What is the power of compounding you mentioned?

Me: PPF calculation uses the compound interest formula and the compounding of the PPF occurs annually.

Investors can use an online PPF calculator to see the results by putting the tenure and total amount invested.

There is another benefit with PPF too. The account can remain active even after maturity, without making any fresh contributions. It continues earning tax-free interest after maturity.

Friend: So, Where is my One Crore Goal?

Me: PPF is a savings scheme for 15 years. But, as a PPF account holder, you can extend the PPF account in a block of 5 years after the completion of 15 years. If you want to use a PPF account to become a crorepati, you need to keep extending the PPF account till the PPF balance becomes ₹ 1 crore.

If you invest ₹ 1.5 lakh per year for 20 years (first extension) at 7.1%, the PPF account balance will be about ₹ 66 lakh, which was ₹ 40 lakh after 15 years.

But, if you extend by another 5 years (second extension), i.e. by investing regularly for 25 years, the PPF balance will be ₹ 1 crore approximately.

Therefore, to become a crorepati by investing in PPF, one needs to save ₹ 1.5 lakh for 25 years (with two extensions) to create a corpus of nearly ₹ 1 crore, assuming the rate of interest remains 7.1 per cent throughout the term. Even if the rate goes up or down, the average interest rate needs to be about 7.1 per cent over 25 years for you to create ₹ 1 crore.

PPF Calculation for investment periods of:

- 15 years

- 20 years

- 25 years

To understand how the power of compounding works in your favour when it comes to PPF calculation, let’s consider the following table which shows the principal invested annually, the PPF interest earned and the PPF maturity value for 15, 20 and 25 year periods*:

| Investment Period | Total PPF Investment | Total Interest Earned | Maturity Amount |

| 15 years | ₹ 22,50,000 | ₹ 18,18,208 | ₹ 40,68,000 |

| 20 years | ₹ 30,00,000 | ₹ 36,58,287 | ₹ 66,58,287 |

| 25 years | ₹ 37,50,000 | ₹ 65,58,012 | ₹ 1,03,08,012 |

*In this PPF calculation example, we have assumed that the annual investment amount is ₹ 1,50,000 and the PPF interest rate is 7.1% per annum (current PPF interest rate).

Further, use this PPF calculator to figure out the returns you can expect on investing a certain amount in a PPF account.

The above example shows the power of compounding when investing in PPF – your maturity amount increases from ₹ 40 lakh to ₹ 1 crore just by continuing investing ₹ 1.5 lakh more in your PPF account for 25 years instead of 15 years.

Loan against PPF

- You can take a loan against your PPF account between the 3rd and 5th year.

- The loan amount can be a maximum of 25% of the 2nd year immediately preceding the loan application year.

- A second loan can be taken before the 6th year if the first loan is repaid fully.

PPF withdrawal

As a rule, one can fully withdraw the PPF account balance only upon maturity i.e. after the completion of 15 years. Upon completion of 15 years, the entire amount standing to the credit of an account holder in the PPF account along with the accrued interest can be withdrawn freely and the account can be closed.

However, if account holders are in need of funds, and wish to withdraw before 15 years, the scheme permits partial withdrawals from year 7 i.e. on completing 6 years.

An account holder can withdraw prematurely, up to a maximum of 50% of the amount that is in the account at the end of the 4th year (preceding the year in which the amount is withdrawn or at the end of the preceding year, whichever is lower). Further, withdrawals can be made only once in a financial year.

Procedure for withdrawal from PPF

In case you wish to partially or completely withdraw the balance lying in your PPF account.

Step 1: Fill in the application form using Form C with relevant information.

Step 2: Submit the application to the concerned branch of the bank where your PPF account lies.

This form is available for download here.

It is important to note that a PPF account cannot be “closed” before maturity. A PPF account, however, can be transferred from one point of designation to another. Only in the case of the account holder’s demise can the nominee’s file for the closure of the account.

Friend: This is awesome. Can you also tell me how to create a ₹ 5 crore retirement corpus?

Me: Hahaha… are you getting greedy now? Anyway, with other investment schemes that offer double-digit returns, you can accumulate up to ₹ 5 crores for your retirement. The amount you need to invest in order to create this corpus of ₹ 5 crores will depend on your time to retirement and the investment option you choose. For example, if your current age is 25 years and you want to retire at the age of 55 years then assuming an annual return of 12%, you need to save ₹ 16,229 every month for the next 30 years in order to accumulate ₹ 5 crores.

The required amount will go up if you delay saving or investment. If you delay it by, say, six years, you will be required to invest ₹ 29,374 every month to accumulate the same amount. The required amount increases drastically with a delay in investment as the effect of compounding reduces.

Bonus:

- The Finance Ministry sets the interest rate every year, which is paid on 31st March. The interest is calculated on the lowest balance between the close of the fifth day and last day of every month.

So as a PPF subscriber, if you wish to maximize your interest earnings, you should deposit your PPF contributions on or before the 5th of every month. The ideal option would be to invest ₹ 1.5 lakh between April 1 and April 5 (the total limit for investing in a year is ₹ 1.5 lakh) at the start of the financial year.

But many would not have the entire sum to invest at the beginning of the year, so they can deposit some amount regularly every month but they should try to deposit it by the 5th of that month to avail the maximum benefit as per the interest calculation method. The amount may be minuscule but why should we let go of interest on our hard-earned money. So next time when you are depositing money in PPF, try to deposit it by the 5th of that month.

The interest is calculated on the minimum balance in the PPF account between the fifth and the end of each month. So in a nutshell, if you invest after the 5th of that month, you will only get interest on the previous month’s balance but if you invest on or before the 5th of that month, then you will get interest on the current month’s balance apart from previous month’s balance.

- Assuming ₹ 6,000 per month investment in PPF account from the age of 25, a salaried person can expect to invest for around 35 years till his or her retirement. Assuming 7.1% average PPF interest rate for the entire 35 years, the PPF calculator suggests that one will be able to accumulate ₹ 1,08,94,971 that can become a huge financial support for the person on retirement.

Invest right now, as interest rates may change later. So to avail of this benefit, start early, this April!

Hey Good information on PPF. Can you also make good notes on Mutual funds and Bitcoin?

Pingback: Don’t make the mistake of NOT teaching money to kids: Part 2 - RushTalks By Rashmi